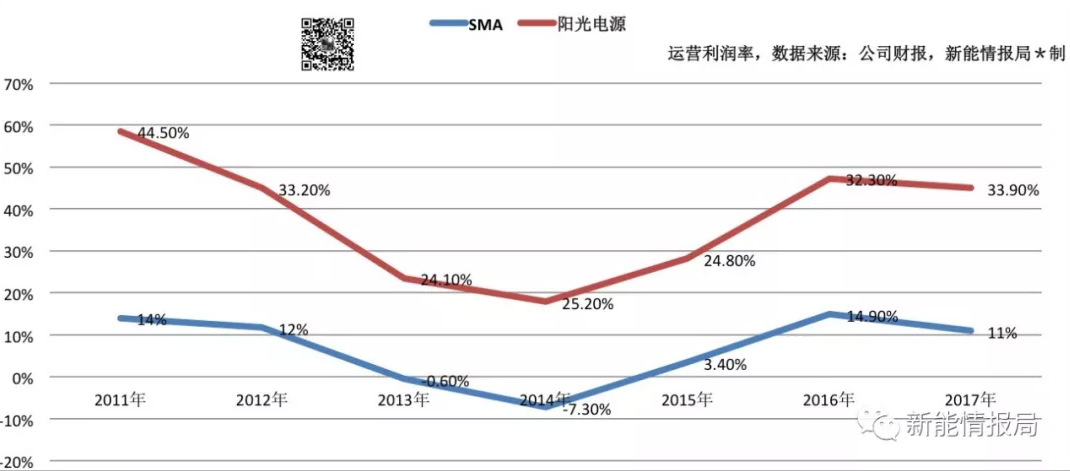

Looking at the development of photovoltaic inverter industry in recent years, the operating margin of mainstream inverter companies reached a high peak in 2011. In the following two years, with the rapid increase of inverter companies, under the fierce competition, the profit level of each inverter company began to decline. "Market transfer" is the driving force of the inverter market, and the market prospect of photovoltaic energy storage has become one of the most promising development directions.

It was not until 2016-2017 that it returned to the relatively ideal profit level under the influence of the substantial growth of market installed capacity (see Figure 1, taking SMA and solar power as examples).

Figure 1: Statistical curve of operating profit margin of SOLAR power and SMA from 2011 to 2017

During the last downturn, the entire inverter industry shrank from more than 300 companies to less than 100. Many domestic inverter companies were eliminated, and overseas inverter companies were not immune. In 2015, AdvancedEnergy, the third largest inverter company in the United States, finally pulled out of the market.

Now, the domestic photovoltaic industry has again encountered the development trough, and the installation volume is likely to show negative growth for the first time in recent years. Meanwhile, referring to the development curve trend of operating profit margin, inverter companies will face another wave of survival and operation test.

Orders are down sharply and inverter companies are under pressure

Recently, the photovoltaic industry inverter two giant solar power, SMA has released the first half of 2018 financial results, in these two report CARDS all people are vaguely aware of the "coming weather" trend.

In the first half of 2018, a total of 4.3GW of SMA inverters were shipped globally with a revenue of 394.6 million euros (3.079 billion yuan), up only 3.5% year-on-year. But in its results, we saw a sharp drop in orders for its undelivered products, which amounted to only 186.5 million euros, down 33% from the same period last year.

SMA said the change in China's photovoltaic policy will significantly reduce overall global demand for installations, further lead to consolidation among inverter companies and put further downward pressure on inverter prices.

In view of this, SMA is pessimistic about the Chinese and global pv markets in the second half of the year, with the Board predicting only 7% annual growth in company access to the market through 2020.

In the first half of 2018, the revenue of Sunshine Power was 3.895 billion yuan, and the net profit attributable to shareholders of the listed company was 383 million yuan, only increasing by 3.75% year-on-year.

But the cash flow from its operations

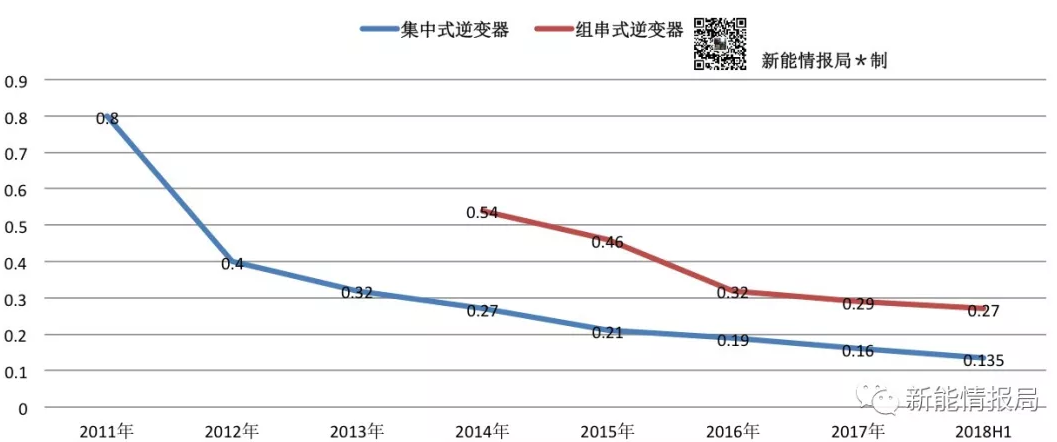

Figure 2: Curve of price change of H1 inverter from 2011 to 2018

"Market transfer" is the driving force of the inverter market. For the entire solar industry, if it wants to survive, it must find a new market. From Europe to Japan and the United States, to China and India, from overseas rooftop pv to Centralized ground power stations in China, to distributed power stations.

Now the domestic distributed adjustment, the second half of the installation is not optimistic, no market can be transferred. Therefore, photovoltaic inverter companies are looking for ways to save themselves, and the market prospect of photovoltaic + energy storage has become one of the most promising development directions.

But can energy storage really be a lifesaver for photovoltaic inverter companies?

According to the statistics of Energy Storage Application Branch of China Chemical and Physical Power Industry Association, by the end of 2017, a total of 32.8GW of energy storage projects had been put into operation, and the installed capacity of new projects had increased to 217.9MW. China's energy storage industry is still at the initial stage.

At the same time, photovoltaic energy storage is only a small part of the energy storage market. How can an industry that is still in the initial stage of development absorb the photovoltaic shipment demand that has already achieved the magnitude of 100GW of installed capacity? The development of reality is still very far from the hope of the enterprise.

Sun power, for example, its early into the storage areas, currently has the world's leading new energy power transformation technology, and relying on the global first-class lithium battery technology, can provide single 5 ~ 1000 kw power energy storage inverters, lithium battery core equipment such as energy storage, energy management system, at the same time introduced the energy move, micro power grid and power frequency modulation and a series of advanced system solutions.

Its energy storage systems are widely used in more than 650 energy storage projects in China, the United States, the United Kingdom, Canada, Germany, Japan, Australia, India, Cambodia, South Sudan and other countries. In the first half of this year, the energy storage project of Qinghai 100 mw photovoltaic power generation demonstration base was obtained in China